Reverse charge invoice generator

Generate invoices based on your Amazon Appstore™ sales

Track app sales, ranks, reviews and more for all of your apps!

Use our link and get $10: appfigures.com

Donations are important! They help us to maintain and improving this service.

This is a free reporting service for Android/Fire OS developers selling apps, in-app purchases or subscriptions on the Amazon Appstore™.

When selling digital goods on the Amazon Appstore, you'll have to remit taxes, and the tax authorities therefore require some form of verification of your earnings, i.e. a receipt or an invoice. Bank statements and the raw financial data you download from iTunes Connect are in most cases not considered as valid receipts for tax purposes.

Also, If your business is based in the European Union (EU) and consumers in the EU purchase your apps and in-app products, there are even more regulations that apply: The tax authorities requires that you periodically file a Recapitulative Statement which shows the amount of earnings originating from the EU.

One way of handling this is to create Reverse charge invoices based on your raw sales data.

Reverse-charge invoicing means that the app developer creates invoices based on payments that already has occurred as a way of normalizing the business model of app sales; basically it can be seen as a way of getting back on track to how tax reporting and accounting normally work. Please note that it is not always required to send the reverse charge invoices provided by this service, to Google, since the invoices are normally only used for accounting and tax reporting purposes.

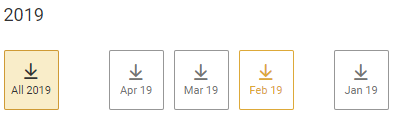

This service creates reverse charge invoices based on the financial data that Amazon provides through the Reporting section of the Developer Portal. On the invoices that this service produces, all earnings are clearly grouped by World regions, where regions are either individual countries, e.g. Japan, Canada or entities like the European Union (EU), where the Amazon corporation has subsidiaries.

We did most of the heavy lifting for you to provide you with useful reverse charge invoices that specify how much of your earnings that comes from each world region. This service makes it effortless to comply with the tax regulations associated with each region.

Tax Reporting

The reverse-charge invoices should also be valid as receipts for your local tax authorities, although we strongly recommend you to verify this yourself

European Union

Companies based in the European Union that are selling digital goods through the Amazon Appstore to consumers also in the EU must periodically report the amount of their earnings originated from the EU to their local tax authorities. Here in Sweden this is called " Periodisk sammanställning", which means "Recapitulative Statement" in English. Other EU countries have similar rules in place: in Germany it's called "Zusammenfassende Meldung", in France "Déclaration Européenne de Services" (DES) etc.

Accounting

The reverse-charge invoices should also be valid for accounting purposes. Your accountant will probably love getting, easy to grasp, invoices, specifying your app sales, instead of being confused by raw app sales data.

Local processing

In order to protect your integrity, we've ensured that your business critical data never leaves your computer. This site does all the job locally using pure javascript on the client (meaning: your browser) and the only thing we do track is anonymous and aggregated data, like the total number of page visits and the number of generated reports using Google Analytics in order to improve this service even further.

We use it

This service is actually something that we as app developers selling apps, in-app purchases and subscriptions, on the App Store, Google Play and Amazon Appstore, developed as a means to automate our own accounting and tax reporting.

Yes, we visit and use this site every month for this exact purpose.

This service should be compatible with the latest version of the desktop Chrome, Firefox and Edge browsers.

If you encounter any problems, don't hesitate to contact us using our web support system.